By Kris Gopal    e-mail: gutcut@comcast.net

As our present government scurried to create a new tax code before the end of 2016, it will be worthwhile to know how the tax code evolved in this country.

The first income tax bill was introduced in 1861 as a one-time event to raise money for the Civil War, which the then president Abraham Lincoln signed into law the same year. It was meant to be a temporary measure with a flat tax rate of 3% on annual incomes above $800 (equivalent to ~ $22,000 per year income today).

In 1862 congress created what would become the Internal Revenue service. This tax law lapsed in 1872, and there was no income tax till the year 1894 when congress passed law to in recreating income tax code. At that time the Supreme Court by vote of 5-4 voted that the income tax code was unconstitutional. A progressive reform group fighting to reintroduce the tax code led to the passage in 1913 of a constitutional amendment – the 16th amendment – legalizing federal taxation. The first implemented permanent tax code had a top rate of 7% on annual incomes above $500,000 which would be equivalent to $12.5 million today.

In 1862 congress created what would become the Internal Revenue service. This tax law lapsed in 1872, and there was no income tax till the year 1894 when congress passed law to in recreating income tax code. At that time the Supreme Court by vote of 5-4 voted that the income tax code was unconstitutional. A progressive reform group fighting to reintroduce the tax code led to the passage in 1913 of a constitutional amendment – the 16th amendment – legalizing federal taxation. The first implemented permanent tax code had a top rate of 7% on annual incomes above $500,000 which would be equivalent to $12.5 million today.

The U.S. Government later passed a massive tax hikes to pay for the world War I, including the first version of the estate tax, and raised the taxes yet again to finance the enormous costs of World War II. In 1944 the top income tax rate peaked at 94 percent on taxable income of over $200,000 (about $2.5 million today).

In 1963 President John F Kennedy slashed the top rate for individuals from 91 percent to a more reasonable 65  percent. This reduction met with still resistance from conservative Democrats and Republicans who worried about the deficit it will entail. When Lyndon Johnson became the president after Kennedy’s assassination, the Revenue Act of 1964 was passed lowering the top individual tax rate to 70 percent and the bottom rate to 14% from 20%. At the same time the corporate tax was also lowered from 52%to 48%.

percent. This reduction met with still resistance from conservative Democrats and Republicans who worried about the deficit it will entail. When Lyndon Johnson became the president after Kennedy’s assassination, the Revenue Act of 1964 was passed lowering the top individual tax rate to 70 percent and the bottom rate to 14% from 20%. At the same time the corporate tax was also lowered from 52%to 48%.

Another seventeen years elapsed before the next tax reform took place under President Ronald Regan. He created the biggest tax cut by slashing the top individual rate from 70% to 50%. He and his advisers revamped the tax code and introduced the 1986 Tax Reform Act simplifying the tax and reduced fifteen tax brackets to just two, 15% and 28% percent. This tax code also eliminated $60 billion tax loopholes. It was felt to be revenue neutral.

To appease few resentful congressmen and senators, Reagan increased the standard deduction to benefit low-income families. He also increased the capital gains tax from 20% to 28%.

Then in 1991, the then citizen Donald Trump told congress that the new tax reforms had been “an absolute catastrophe for the country.â€

President George W Bush pushed through a major tax cut in 2001. Later Democratic presidents have raised the top tax rate to 39.6% and the number of tax brackets was expanded to seven and several new tax breaks and loopholes were been added.

During President Donald Trump’s first year in office, the Republican controlled House and Senate succeeded in rewriting the tax code. After cantankerous debates both in the House and Senate, the Republicans managed to pass the bill, solely along the party-line vote. It was necessary to raise the debt ceiling. The new tax bill reduces the corporate tax from 35% to 21%. It reduces personal tax bracket from eight to seven. It reduces individual taxes to many Americans. The new bill increases the personal standard deductions from $12,000 to $24,000. The present bill reduces the property taxes and state taxes deduction to $10,000. It reduces mortgage interest deductions for new houses up to $750,000. Some changes were also made in the estate taxes, and alternate minimum tax, and gift taxes.

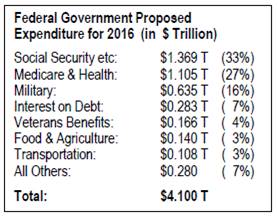

The new budget increase spending on defense, infrastructure improvements, mental health care, and Catastrophic Fund. This new tax law will not be budget neutral and will leave an enormous deficit. Congressmen of the future will have to reconcile with this huge budget deficit.

References: