By Kollengode S. Venkataraman

e-mail:Â ThePatrika@aol.com

For the year 2010, the federal budget’s total tax receipts (personal, corporate, and other taxes, excise and custom duties, etc. is $2,380 billion. Nearly 45% of this ($1,060 billion) is personal income tax, corporate taxes accounting for only 9.3% (or $222 billion). Nearly 39% ($940 billion) is social security taxes for paying retirees down the road.

The federal government’s expenditure is $3,550 billion. This leads to a whopping $1,170 billion deficit, or nearly 50% of the tax receipts.

On the expense side, 2,180 billion mandatory expenditure. In this, Social Security is $678 billion; Unemployment, welfare, etc. $571 billion; Medicare, $453 billion; Medicaid and children health insurance grants to the states, $290 billion; interest on national debt, $164 billion. Excepting interest on debts, nothing is “mandatory.†They can be changed by law.

The rest, $1,370 billion of expenses are on what are called discretionary expenditure — defense, $664 billion (50% of the discretionary expenditure); Health and Human Services; $79 Billion; Transportation, $72.5 billon; Veterans Affairs, $53 billion; Housing and Urban Dev., $47 billion; Education, $47 billion; Homeland Security, $43 billion. All other departments and agencies combined is $312 billion.

So in simple terms, our federal government is like a small business having annual revenue of $250,000 but with an expenditure of $350,000. This small business would close down after one or two years. But we in the US, against dire warnings from many honorable citizens for years, have been living by borrowing money from Communist China, totalitarian Middle East Sheikhdoms, and others for years and years. The national debt today for the federal government is nearly $15,000 billion.

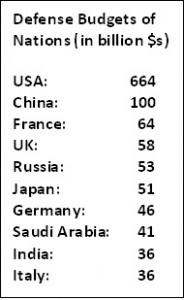

Our defense budget of $664 billion is 43% of the whole world’s – 180-plus countries’ — defense expenditure of $1,530 billion. The total expenditure on defense for the next 10 largest countries (China, France, Britain, Russia, Japan, Germany, Saudi Arabia, India, Italy and Brazil in decreasing order) is much less, only $486 billion. US defense expenditure is 6.5 times the defense expenditure of China ($100 billion), the second largest defense budget next to the US; and 10 times that of France (64 billion). See the list below. Given our fiscal woes, such a huge military budget is unsustainable. Our huge military buildup — over 750 military installations, big and small, outside the US in 70-plus countries — is now a burden.

It is not easy for the government to extricate itself from the grip of the military and high-tech weapon industries. With their own self-fulfilling logic and clout in Congress, they keep coming up with new rationale, and newer, ever more sophisticated, and always costlier weapons systems.

It is not easy for the government to extricate itself from the grip of the military and high-tech weapon industries. With their own self-fulfilling logic and clout in Congress, they keep coming up with new rationale, and newer, ever more sophisticated, and always costlier weapons systems.

In 2001, the Congressional Budget Office hadestimated that for the year 2010-11, the federal budget would have $850 billion surplus. So, from an $850 billion projected surplus, we have nosedived to a 1,170 billion real deficit, a drop of over $2,000 billion. The main causes for this, as shown by the New York Times, are the economic downturn during George W. Bush’s first term ($ 290 billion), his Iraq War, tax cuts, and Medicare Part D prescription drugs ($670 billion), and  $470 billion during 2008-09 recession, totaling over $1,300 billion. Obama’s relatively smaller banking bailout only compounded the nation’s woes.

The situation in many state and local governments are gloomy as well. Over 44 of our 50 states (including California, New York, New Jersey, Illinois, and Pennsylvania) have budget deficits totaling $350 billion. Local governments throughout the nation, including the City of Pittsburgh, too have fiscal problems. The reasons are reduced tax receipts on account of the bad economy, unfunded commitments for padded pensions and liberal healthcare benefits for retirees, among others.

However you slice it, the prognosis for the combined fiscal woes of federal, state and local levels is not good. The eternal optimism traditionally espoused by many in the US — that technological booms based on our innovative instincts are just round the corner to bail us out — may be misplaced today. The world has changed. We have lost our edge in manufacturing, and become a service-based consumer economy. You cannot be the Sole Superpower with a weakened manufacturing base. Service jobs don’t pay well, and often don’t give benefits. Forget pensions. Meanwhile other nations are investing on education, innovation, manufacturing, thus shrinking our lead-time over others in our technological edge.

In earlier times, we benefited by the economic activity triggered by wars, as in WW I and II and the Cold War. We do not have that option now. We are already in two costly wars – in Iraq and Afghanistan — more or less by ourselves for nearly eight years, with nobody of substance to share the financial, military, and political burden. Only 1% of the nation’s population of 300-plus million is personally involved in the wars, with many men and women in uniform having multiple tours of duty. For the remaining 99% of the population, the impact of the wars is minuscule. There is no draft, and there is not even a financial obligation on citizens not in combat like an income-based War Tax. In fact, Bush-43 gave tax cuts in the midst of war. We cannot escape the consequences of all these financial excesses.

Rich nations lead by the US, through the World Bank and the International Monetary Fund, used to hector Third World countries in fiscal crises on austerity measures like devaluation, opening up for foreign direct investment, eliminating tariffs and subsidies (even as the rich nations were protecting their own industries). Now it is time we take the medicine we were prescribing for everybody else. It is already happening in Europe (Greece, Ireland, Iceland, Portugal and Spain).

That is precisely what the Simpson-Bowles Fiscal Commission appointed by President Obama recommends in their report (www.fiscal commission.gov/news See the item Moment of Truth): Trim all expenditures and subsidies, without any exception, including military, social security and Medicare. Its suggests simplified tax codes, a modest 15 cents/gallon gas tax, and removing tax loopholes. Everybody shares the burden. The rich will have to share more, as it should be. After all, they benefited the most from the fiscal irresponsibility of the last 30 years.

That both Democratic and Rightwing commentators denounced the report tells us that it is truly fair and balanced. Surprisingly, 11 of the 18 members of the commission endorsed the report. So, let’s get ready for some serious, inescapable belt tightening. This time around, it seems likely, we may have the courage and wisdom to do the right things. As the most powerful nation in the world with over forty Nobel prizes in economics, if we do not tighten our belt on our own choice, outside forces will impose it on us. Then we will be no different from the wretched Third World. ♦